Where are the promised reforms ?

Power Politics Bureau

After known

f r a u d s t e r s

Vijay Mallya

and Lalit

Modi, the

country is

caught in yet another

massive banking fraud by

billionaire jewellery

designer Nirav Modi. The question

here is not one of starting year

(2011) of the scam or the colour of

government in the saddle –– the

Congress-led UPA or the BJP-led

NDA.

What is a matter of concern for

the people is the leaky banking

system and the quality of

governance which help fraudsters and not

loan-ridden suicideprone

farmers, poor

account holders in

public sector banks

whose small deposits

shrink regularly

since they cannot

maintain a minimum

balance. This is not the India we

had bargained for.

After known fraudsters

Vijay Mallya and Lalit

Modi, the country is

caught in yet another

massive banking fraud by

billionaire jewellery

designer Nirav Modi.

Ravi Shankar Prasad

Ten years of the UPA

establishment (2004 to mid-2014)

was scam-ridden even though

it had an honest economist Prime

Minister in Manmohan Singh

at the helm. The scams during

that period were the main

reason for the Congress to lose power at the hustings.

Ravi Shankar Prasad

Ten years of the UPA

establishment (2004 to mid-2014)

was scam-ridden even though

it had an honest economist Prime

Minister in Manmohan Singh

at the helm. The scams during

that period were the main

reason for the Congress to lose power at the hustings.

In place of the Congress,

landed on the nation's centrestage

of power the saffron

party's Narendrabhai Modi.

During his hurricane poll

campaign, he promised to

conduct himself as "chowkidar"

of the national treasury,

initiate reforms and install a

transparent and accountable

system of good governance.

It is a different matter that

the country saw the vanishing

tricks of the scamsters – Vijay

Mallya, Lalit Modi and Nirav

Modi ––during the past four

years of "chowkidari" of Prime

Minister Modi!

Public sector banks in India

have lost at least Rs 227.43 billion

(Rs 22,743 crore) because of

fraudulent banking operations

between 2012 and 2016,

according to an IIM-Bangalore

study. Electronics and

Information technology minister

Ravi Shankar Prasad gave this

information to Parliament, citing

Reserve Bank of India (RBI) data.

Public sector banks in India

have lost at least Rs 227.43 billion

(Rs 22,743 crore) because of

fraudulent banking operations

between 2012 and 2016,

according to an IIM-Bangalore

study. Electronics and

Information technology minister

Ravi Shankar Prasad gave this

information to Parliament, citing

Reserve Bank of India (RBI) data.

The honourable minister has

said there have been over 25,600

cases of banking fraud, worth Rs.

1.79 billion up to December 21

last year. According to the data,

released by the apex bank for the

first nine months of FY 17,

approximately 455 cases of fraud

tansactions, each of Rs 1,00,000 or

above, were detected at ICICI

Bank: 429 at State Bank of India,

244 at Standard Chartered Bank

and 237 at HDFC Bank.

The honourable minister has

said there have been over 25,600

cases of banking fraud, worth Rs.

1.79 billion up to December 21

last year. According to the data,

released by the apex bank for the

first nine months of FY 17,

approximately 455 cases of fraud

tansactions, each of Rs 1,00,000 or

above, were detected at ICICI

Bank: 429 at State Bank of India,

244 at Standard Chartered Bank

and 237 at HDFC Bank.

Between April and December

2016, over 3,500 cases of

fraudulent transactions were

reported involving Rs 177.50

billion, which were facilitated by

450 private and public sector

employees and the vulnerable

banking system.

Between April and December

2016, over 3,500 cases of

fraudulent transactions were

reported involving Rs 177.50

billion, which were facilitated by

450 private and public sector

employees and the vulnerable

banking system.

The latest scam "bombshell"

has hit the state-run Punjab

National Bank's Brady House

branch in Mumbai where Nirav

Modi and his associates allegedly

The latest scam "bombshell"

has hit the state-run Punjab

National Bank's Brady House

branch in Mumbai where Nirav

Modi and his associates allegedly

The honourable

minister has said

there have been over

25,600 cases of

banking fraud, worth

Rs. 1.79 billion up to

December 21 last

year. According to the

data, released by the

apex bank for the first

nine months of FY 17,

approximately 455

cases of fraud

tansactions, each of

Rs 1,00,000 or above,

were detected at ICICI

Bank: 429 at State

Bank of India, 244 at

Standard Chartered

Bank and 237 at HDFC

Bank.

indulged in "fraudulent and

unauthorized" transactions to the

tune of Rs 11,450 crore in

connivance with some members of

the PNP staff. The Nirav Modi

group reportedly managed to get at

least 150 Letter of Undertakings

(LoUs) fraudulently which enabled

them to defraud the bank. The LoUs

were encashed overseas by them

from different banks. Union Bank

of India, Allahabad Bank and Axis

Bank are said to have given them

loans based on PNB's LoUs.

The value of fraudulent

transactions works out more than

eight times PNB's annual net

profit of Rs 1,324 crore during

2016-17. Nirav Modi, incidently,

figured in Forbes India's Richest

People List of 2016, with a net

worth of $ 1.74 billion.

Notwithstanding earlier alarm

signals from a whistle blower, the

PNB's Brady House branch

discovered irregularities in issue of

letters of undertaking (LoUs) only

in mid-January this year. PNB has

Rs 1,700 crore loan exposure to

Nirav Modi's tainted companies in

addition to liabilities up to Rs

11,400 crore.

It is worth noting that LoU

operationally works out to be a

letter of comfort issued by one

bank to branches of other banks,

based on which foreign branches

offer credit to buyers. According

to a report, "foreign branches of

these banks which have dealings

with outlets of a jewellery

company are said to have taken

significant exposures". All this

was carried out in connivance

with PNB officials. We are yet to

fully know all the facts and the

range and dimensions of the scam

operation. Central agencies are

on the job.

True, the pile of bad loans is a

legacy of the UPA government. It

is also a fact that Prime Minister

Modi's government had promised

at the start of its term in May

2014 that a clean-up of bank

balance sheets of state-owned

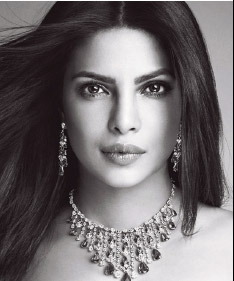

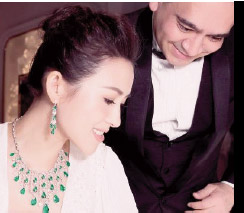

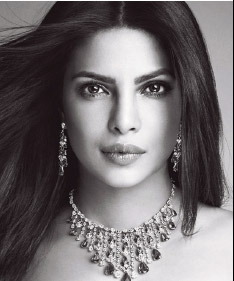

Nirav Modi at the

opening of their Hong

Kong boutique.

banks would be one of its

primary challenges. Even the

2015-16 Economic Survey had

spelt out the road ahead. Still,

nothing much has been done to

improve the banking system

and initiate the process of

promised governance reforms.

There are obvious supervisory

failures both at the levels of

individual banks and the

banking sector regulator, RBI.

Nirav Modi at the

opening of their Hong

Kong boutique.

banks would be one of its

primary challenges. Even the

2015-16 Economic Survey had

spelt out the road ahead. Still,

nothing much has been done to

improve the banking system

and initiate the process of

promised governance reforms.

There are obvious supervisory

failures both at the levels of

individual banks and the

banking sector regulator, RBI.

The scam raises a number of

questions on the operative system

of governing public sector banks.

Gokulnath Shetty

First, LoUs for diamond trade

are issued for 90 days. How

come the bank staff issued 365

day LoUs? This shows how rules

are flouted by the banking staff

for the rich and the mighty who

know the art of managing key

persons within and beyond. No

wonder, the richest one per

cent of Indians own 53 per cent

of the country's wealth.

Gokulnath Shetty

First, LoUs for diamond trade

are issued for 90 days. How

come the bank staff issued 365

day LoUs? This shows how rules

are flouted by the banking staff

for the rich and the mighty who

know the art of managing key

persons within and beyond. No

wonder, the richest one per

cent of Indians own 53 per cent

of the country's wealth.

Second, how come the PNB's

internal audits and RBI

inspections failed to notice

irregularities?

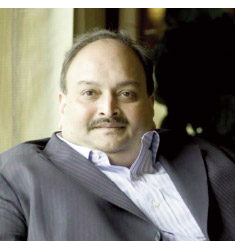

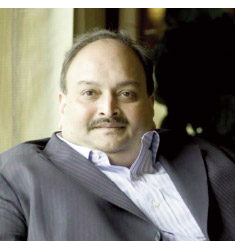

Mehul Choksi

Third, at the operative desk,

why was PNB's deputy manager

Gokulnath Shetty allowed to

remain on the same desk for

years, flouting the norms of

rotating people every few

months? Shetty allegedly used his

access to the Swift messaging

system used by banks for

overseas transactions to

authenticate guarantees given on

LoUs without any sanctions.

Based on such authentications,

overseas branches of several

Indian banks gave forex credit.

PNB is now denying liability,

claiming that these are

fraudulent LoUs. My point is:

such things cannot happen

without the power strings of some

invisible hands, both inside and

outside of PNB.

Mehul Choksi

Third, at the operative desk,

why was PNB's deputy manager

Gokulnath Shetty allowed to

remain on the same desk for

years, flouting the norms of

rotating people every few

months? Shetty allegedly used his

access to the Swift messaging

system used by banks for

overseas transactions to

authenticate guarantees given on

LoUs without any sanctions.

Based on such authentications,

overseas branches of several

Indian banks gave forex credit.

PNB is now denying liability,

claiming that these are

fraudulent LoUs. My point is:

such things cannot happen

without the power strings of some

invisible hands, both inside and

outside of PNB.

It is said that power

flows from money-bags.

And money-bags flow

from power. To whom

can the common man

turn when money and

power work in tandem?

A grab mentality could

be seen everywhere.

Four, like Vijay Mallya earlier,

how come Nirav and his kin

managed to leave the country for

their foreign destinations in the

first week of January? This cannot

happen without the help of some

government officials. Equally

intriguing is that Nirav could

manage to get into the

businessmen's group photograph

with Prime Minister Modi at Davos.

He was surely not part of the

official Indian delegation. Still, how

could he manage to slip in the

group photograph?

Five, the people have the right to

ask as to why various ministries

and the PMO repeatedly overlooked

complaints of wrong-doings against

Nirav and his partner Mehul Choksi

filed by a whistle-blower? Could

this be because of the Prime

Minister's preoccupation with

foreign trips to project the Shining

India image for the flow of foreign

investments for his various

schemes, including Make-in-India ?

It is a pity that in the Prime

Minister's lopsided priorities, some

of the burning domestic issues and

problems facing the country have

either been neglected or got

sidelined. With one year to go for

the next general election, the Modi

government has now woken up to

address itself to farmers' hackbreaking

problems and inject some

life in the economy and the health

sector. But one year is too short a

period to make India shine and

create promised jobs for millions of

the unemployed.

As for Nirav Modi's affairs, law

has moved in swiftly, though we

cannot be sure of the net result

since there are visible and invisible

wheels within wheels in loose ends

of the system. One cannot be sure

which wheel is operating at whose

behest. Incidentally, Nirave Modi

has a brother Neeshal Modi who is

also a partner in his diamond

business. Last year he married

Ambani brothers' sister Deepti

Salgaonkar's daughter Isheta.

The rest is all a matter of guess.

It is said that power flows

from money-bags. And moneybags

flow from power. To whom

can the common man turn when

money and power work in

tandem? A grab mentality could

be seen everywhere.

Salgaonkar's daughter Isheta.

The rest is all a matter of guess.

It is said that power flows

from money-bags. And moneybags

flow from power. To whom

can the common man turn when

money and power work in

tandem? A grab mentality could

be seen everywhere.

Those who are a part of the

system exploit it, and virtually

become insensitive to the

sufferings of the less privileged.

Indeed, what is disquieting it

that scams, frauds and corrupt

practices in the system indulge

in by the rich and the powerful

has begun to hit the common

man badly.

On the face of it, the

situation seems hopeless. But all is not lost as yet. All that is

required is to build up public

pressure through free flow of

information. The current air of

secrecy has to end. Secretiveness

is the antithesis of democracy. In

India, the ruling class has made a

virtue of it.

On the face of it, the

situation seems hopeless. But all is not lost as yet. All that is

required is to build up public

pressure through free flow of

information. The current air of

secrecy has to end. Secretiveness

is the antithesis of democracy. In

India, the ruling class has made a

virtue of it.

It is imperative that the sluice

gates of misinformation are

identified and closed, whether they

are operated by state agencies or by

non-official agencies.

I wish to reiterate that less of

secrecy and more of openness are

basic ingredients for building a

transparent and accountable

system. Let there be fair play and

fairness in the system. This alone

can help build the confidence of

common people in the system.

Ravi Shankar Prasad

Ravi Shankar Prasad

Nirav Modi at the

opening of their Hong

Kong boutique.

Nirav Modi at the

opening of their Hong

Kong boutique. Gokulnath Shetty

Gokulnath Shetty Mehul Choksi

Mehul Choksi