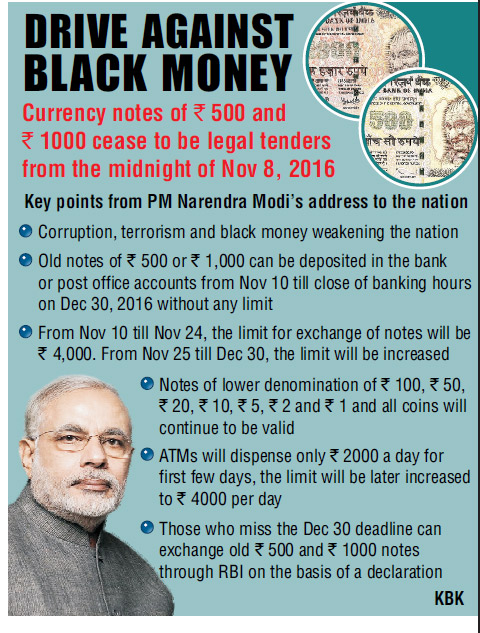

Inept handling

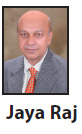

By the time this issue

of the Power

Politics comes out,

the 50-days

'forbearance time'

that Prime Minister Narendra Modi had sought to

restore normalcy in banking

would be over.

By the time this issue

of the Power

Politics comes out,

the 50-days

'forbearance time'

that Prime Minister Narendra Modi had sought to

restore normalcy in banking

would be over.

Going by the increasing

difficulties, the ordinary persons

face at the banks and sales

points as a result of the

demonetisation of the old ₹ 500

and ₹ 1000 notes, it looks like the

problems being faced would

linger on into the next financial

year.

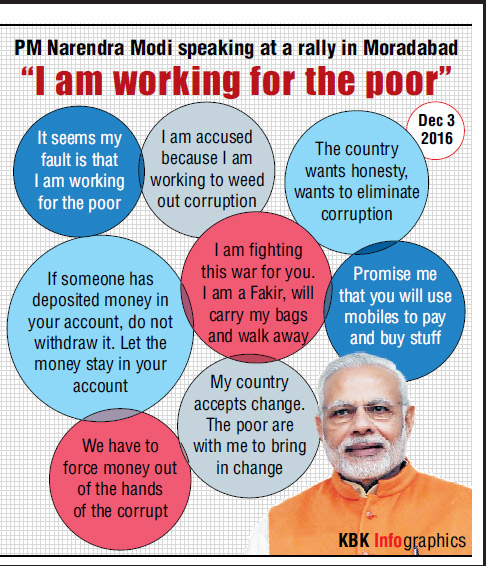

This is quiet contrary to Prime

Minister Narendra Modi's initial

assurance that "the a degree of inconvenience; but

this short-term pain will pave

way for long-term gains."

Finance Minister Arun Jaitley had

said the recalibration of ATM

machines for the new notes

dispensation would take only a

month. But that did not happen.

Now he says the currency

shortage would be over in 2-3

weeks (that is, by Janaury 1st

week).

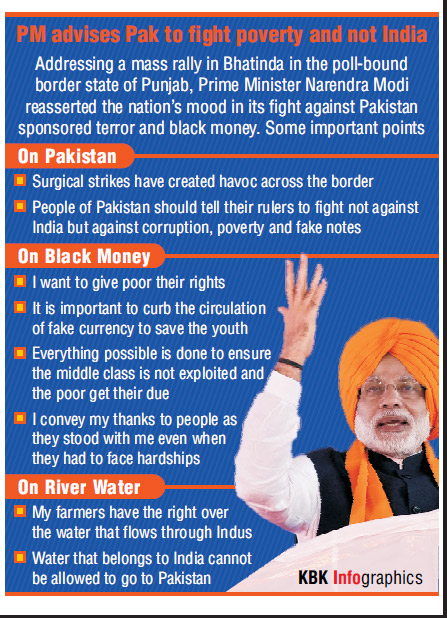

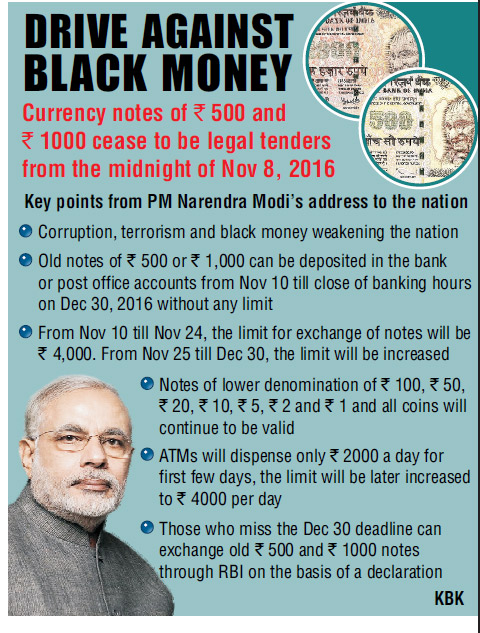

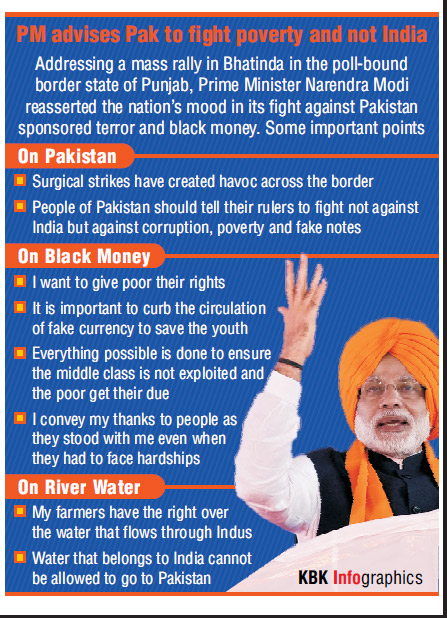

Despite the difficulties,

majority of the people standing initiative as a "mahayagna" "against corruption, black

money, fake notes and terrorism" that would give the

citizens "the India of your dreams".

People also agreed with the prime minister that "It

has been a matter of concern for all of us that

corruption and black money tend to be accepted as

part of life. This type of thinking has afflicted our

politics, our administration and our society like an

infestation of termites. None of our public institutions

is free from these termites".

Urjit Patel

The reality on the ground today is that there is no

sign of tapering of the long queues at banks and cash

machines. Bank branches after serving about a

hundred customers a

day often report that

they have run out of

cash for the day. The

situation in rural and

far flung areas is even

worse. It is obvious

that the ordinary

citizens are facing lot

of difficulties because

of the inept handling

of the

d emo n e t i s a t i o n

management.

Urjit Patel

The reality on the ground today is that there is no

sign of tapering of the long queues at banks and cash

machines. Bank branches after serving about a

hundred customers a

day often report that

they have run out of

cash for the day. The

situation in rural and

far flung areas is even

worse. It is obvious

that the ordinary

citizens are facing lot

of difficulties because

of the inept handling

of the

d emo n e t i s a t i o n

management.

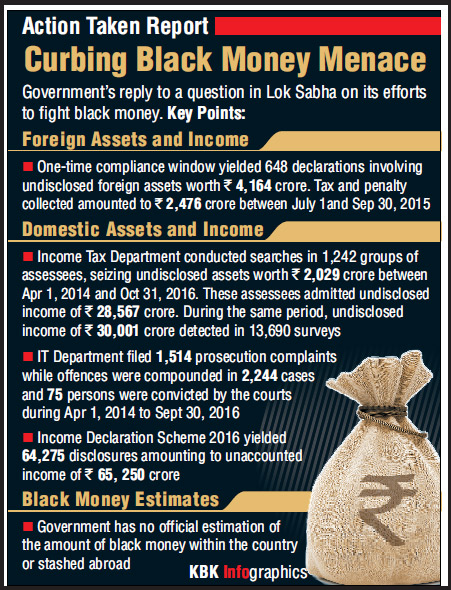

It also belies the central bank governor Urjit Patel's

claim that the preparations for the demonetisation

and printing of new currency notes had been initiated

six months before the note ban. But the arrival of the

new notes at the banking points has faulted severely

and people are suffering.

Manmohan Singh

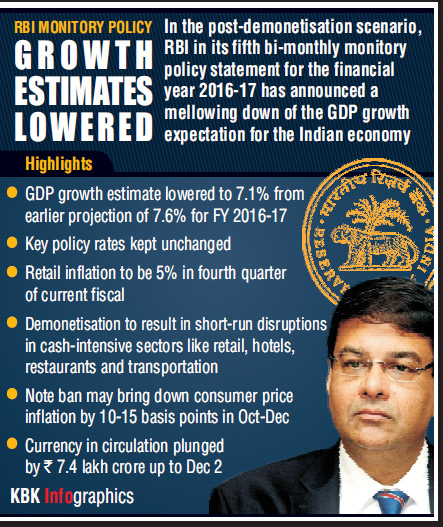

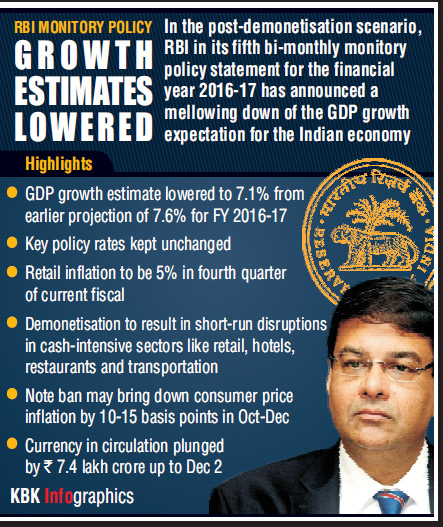

Both the Opposition and economy monitors have

pointed out that inept

handling of the

monetisation and

continuing cash crunch

would adversely affect

growth in all sectors of the

economy. The Reserve Bank

itself downgraded the GDP

growth prospects for the

year by 0.5 per cent. Former

Prime minister Manmohan

Singh estimates it to go

down by two per cent note, said that India's GDP

growth rate would likely fall to 6.5 per cent in the third

quarter and stay subdued at 7 per cent in the

subsequent three months with the cash shortage

expected to continue.

Manmohan Singh

Both the Opposition and economy monitors have

pointed out that inept

handling of the

monetisation and

continuing cash crunch

would adversely affect

growth in all sectors of the

economy. The Reserve Bank

itself downgraded the GDP

growth prospects for the

year by 0.5 per cent. Former

Prime minister Manmohan

Singh estimates it to go

down by two per cent note, said that India's GDP

growth rate would likely fall to 6.5 per cent in the third

quarter and stay subdued at 7 per cent in the

subsequent three months with the cash shortage

expected to continue.

Reports are emanating from different parts of the

country of huge catches of stashes of the new

currency notes from influential people with political

clout, pointing to the collusion of bank officials. Many

such officials belonging to some private banks have

been taken into custody.

Arun Jaitley

The government itself is often changing the

narratives on the note ban and management of its

after effects. It has made several changes to the

norms which were first announced on November 8. It

points to the government's indecisiveness and gives

the impression that the

d e m o n e t i s a t i o n

decision had been

taken with inept

planning.

Arun Jaitley

The government itself is often changing the

narratives on the note ban and management of its

after effects. It has made several changes to the

norms which were first announced on November 8. It

points to the government's indecisiveness and gives

the impression that the

d e m o n e t i s a t i o n

decision had been

taken with inept

planning.

Initially, it was said

the note ban is basically

to tackle the menace of

black money. Then it

was said the objective

was to introduce

minimum currency

concept country.

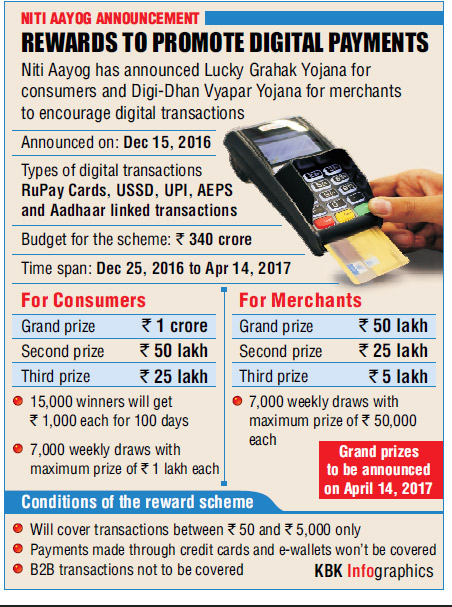

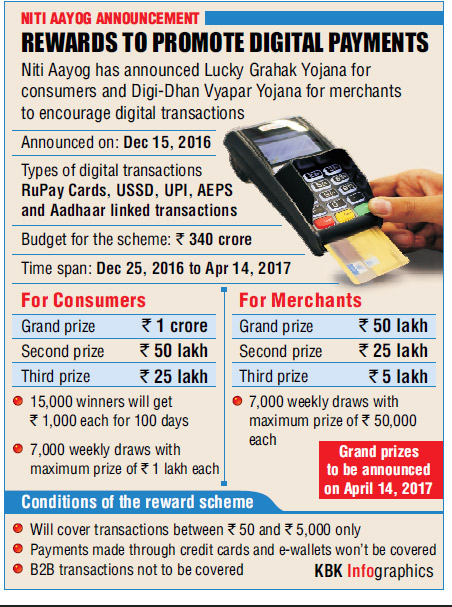

Subsequently it was designated to bring in digital

transactions.

Finance Minister Jaitley said it is to help make all

future transactions substantially digital as India

moves towards a less-cash society. He also hinted at

lower direct and indirect tax rates in future as

demonetisation results in higher tax revenues from

unaccounted wealth coming into the system.

When the government initiated the 'Jan Dhan' bank

account opening scheme in the beginning, it was

stated that the objective was to bring every family into

the banking net. But critics say that the initiative

covered only half of the households in the country. If

note ban and bank payments were in the concept,

there should have been a vigorous campaign to bring

all into banking network.

Similarly, a campaign to introduce card payment at

large number of retail points should have been taken

up. It is obvious that the government faulted in

making appropriate ground work for all these stated

objectives of demonetisation.

The Supreme Court also questioned the

government for not doing enough to ease the cash

crunch in the country and warned that the situation

was getting serious that riots could break out.

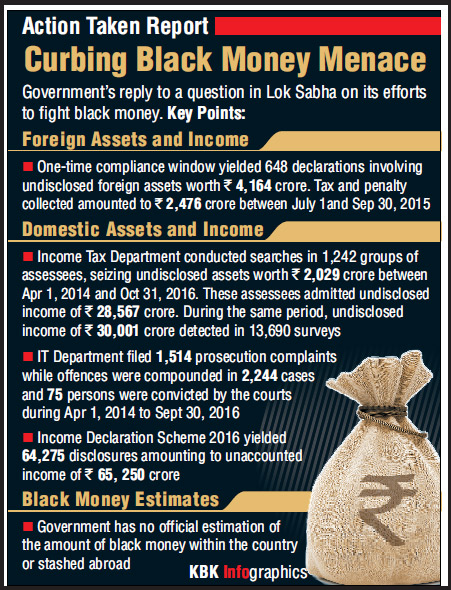

After the first month of demonetisation, data point

out to the possibility that immediate gains from the

drive are unlikely to be anything significant than one

had hoped for. This is unless the government comes

out with a big number on the amount of unaccounted cash uncovered and taxed to benefit the exchequer.

The government itself allowed retaining of black money

if half of it is paid as tax.

Jagdish Bhagwati

There is also a growing apprehension whether the

government would really succeed in achieving the

stated objectives of the demonetisation and targeted

currency circulation objective.

Jagdish Bhagwati

There is also a growing apprehension whether the

government would really succeed in achieving the

stated objectives of the demonetisation and targeted

currency circulation objective.

Speculations that the government will benefit from a

"windfall" gain from RBI when a significant chunk of

currency notes do not find their way back to the

system, has ended after RBI governor Urjit Patel

clarified that there is no plan to give any special

dividend to the government.

However, eminent

economist Jagdish

Bhagwati maintains

that the massive

deposits with banks

post demonetisation

may push the

government for slight

increase in

expenditures of

various social

programmes. "Around

80 per cent of the currency in higher denominations

has now been deposited back into bank accounts. Since

individual deposits will now be matched with their tax

returns and unaccounted deposits will be taxed, this

will yield a windfall for the government permitting

large increases in social expenditures," he said.

Former UIDAI Chairman Nandan Nilekani hailed the

government's demonetisation move and said that it

would see a massive activation of digitisation of

financial services in the country. He also said that

Aadhaar, UPI, USSD and micro ATMs will help India

accelerate the roll out of digital financial services.

"What would have taken another 3-6 years to get rolled

out, Because of the urgency of the matter, it will

happen in 3-6 months," Nilekani said.

However, former economic advisor to the

government and ex-World Bank chief economist

Kaushik Basu said "Demonetisation will cause the

economy to run into great difficulties in the future. He

said "Even the idea of walking towards a cashless

society is a long stretch for India. Currently, close to 98

per cent transactions take place through cash. He said

even the US would take 10-12 years to achieve such a

goal.

The worse is that the inept handling of the postdemonetisation

management has resulted in wash out

of the winter session of Parliament which, in turn,

would delay the introduction of the Goods and Services

Tax (GST).

Urjit Patel

Urjit Patel Manmohan Singh

Manmohan Singh

Arun Jaitley

Arun Jaitley

Jagdish Bhagwati

Jagdish Bhagwati